Trade Credit Insurance - Tailored to your needs

A Flexible Credit Insurance Solution

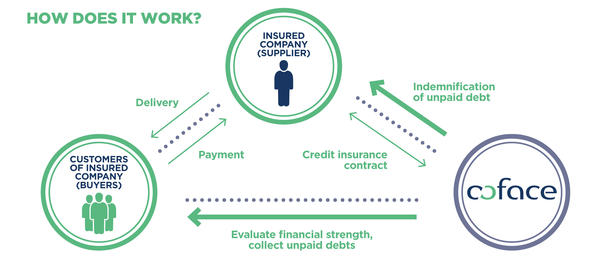

TradeLiner offers solid cash flow protection and efficient credit management support to bring you peace of mind, financial stability, and ultimately facilitate the healthy growth of your business. It is also a customised solution due to the many options available to cover various types of risks.

An Alternative Solution

Apply online

EasyLiner protects you against unpaid invoices in a few simple clicks at a cost effective price.

EasyLiner is a credit insurance package for businesses trading less than £3 million per year.

Backed by EasyLiner, you can fine-tune and enhance your credit procedures and, as a result, grow your business safely. EasyLiner can also help you secure better borrowing terms and access more working capital facilities from financiers by assigning the insurance policy to them as security.

It is easy to subscribe to EasyLiner and in a few clicks, your online quotation and contract will be available to view. Get a quote online now at https://cofaceuk.onlinecreditpolicy.com and, in just a few minutes, discover all the advantages of EasyLiner.

Insuring a single customer

Complete piece of mind when dealing with a key customer

Our Single Buyer Policy helps you avoid the risks associated with non-payment by one single customer, a customer who may represent a large share of your volume sales and revenue.

Alternatively, you may have a more immediate concern, for example, the implications of increased financial exposure as a result of winning a large order from an existing or new customer.

This policy ensures a more predictable cash flow in the event of a protracted default by or insolvency of this key customer.