Sector assessments in the world, the persistence of high risks

2015 marked by the persistence of high risks around the world

4th quarter 2015: no improvements but new declines

4th quarter 2015: no improvements but new declines

The new downward revision of sectorial evaluations reflects the number of burdensome realities faced by industries. The most obvious of these factors is the slowdown in sales, for reasons specific to each sector.

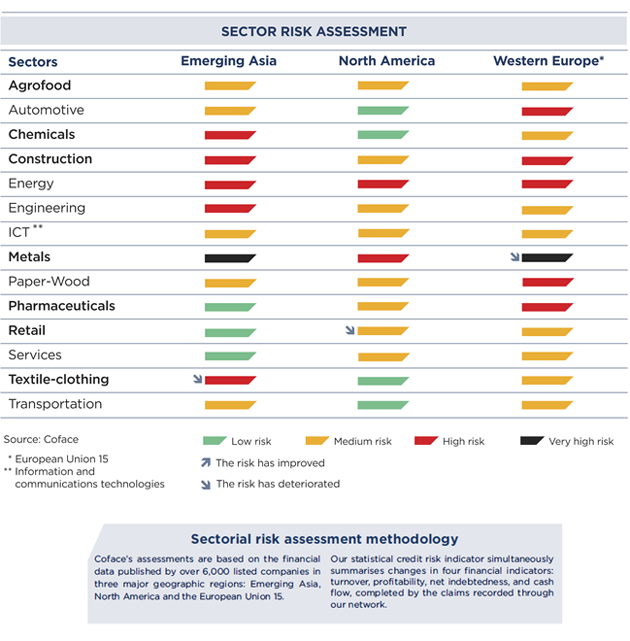

- As regards the textile and clothing sector in emerging Asia, the slowdown in apparel sales is coupled with the decline of China’s cost competitiveness (a country which accounts for 70% of the region’s GDP) and with the challenges in cotton inventories - the principal raw material used for apparel. The return of uncertainties for producers leads Coface to downgrade this sector as ‘high’ risk.

- The slowdown in retail sales in the United States and especially in Canada (which experienced a recession during the first half of 2015), is at the root of the revision of North America’s retail sector to ‘medium’ risk. The dependence of Canada’s economy on oil and household debt are impacting consumption, which slowed down to 1.7% year-on-year at the end of the third quarter, compared to 2.6% in 2014. The withdrawal of the distributor Target from the Canadian market illustrates the perceived rise in risks for companies in this sector.

Price falls are an additional threat.

- Despite the signs of a recovery in construction and the dynamism of automobile sales supporting the demand for metals,metals in Western Europe is going through a difficult period. Steel production is declining in favour of low-cost imports from Asia. During the first seven months of 2015, Europe imported twice as much steel from China as it did in 2013. An anti-dumping tax, implemented in August for six months by the European Commission, is expected to help European industrialists regain their competitiveness. In the meantime, Coface warns against destabilisation in this sector, with its assessment in the ‘very high’ risk category.

In 2015, one-third of sectors assessed in the ‘high’ and ‘very high’ risk categories

Of the fourteen sectors of activity monitored by Coface economists in three large regions of the world, which represent 73% of global GDP, nine were reviewed in 2015. There were more downgrades than upgrades in the levels of risk. The biggest loser of the year was energy in the United States. This sector, which underwent two downgrades, was penalised by drastic cuts in investments and the high level of indebtedness of companies working in exploration and production as a result of the drop in oil prices. At a global level, metals is by far the sector most at risk, assessed as ‘very high’ risk in emerging Asia and now also in Western Europe.

The two improvements concern Western Europe, where chemicals and ICT (information and communication technologies) sectors were upgraded as ‘medium’ risk in October 2015. Despite this good news, the recovery is still too disparate for all of the sectors in the zone to benefit from it.Western Europeis the most stricken region, with none of the sectors assessed at this time at ‘low’ risk.

“In 2015, sector risks have deteriorated in comparison to 2014”,commented Paul Chollet,economist at Coface.“One-third of the sectors are now assessed as ‘high’ or ‘very high’ risk, and no region is spared. Greater control over risks is required. This is at the heart of our conception of the role of credit insurer, thanks in particular to our fifty centres devoted to collecting, processing and analysing information, which are located as close as possible to companies.”

INFOGRAphICS : SECTOR RISKS - 4TH QUARTER 2015